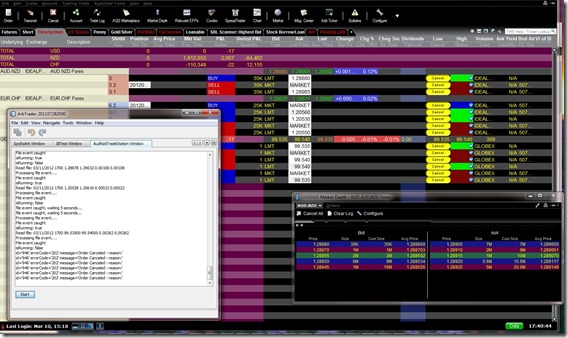

My test with a time-based strategy on AUD/NZD, EUR/CHF and Eurodollars continued the week of March 26th. Other time constraints over the weekend prevented me from posting the results as soon as the week closed out. There are still a couple of major outstanding issues. The first and biggest was that I was notified by Interactive Brokers that I was placing too many order modification requests relative to the number of orders that were actually getting executed. The software had not been optimized to not place an order modification if the limit prices from the previous period had not changed. I needed to make a modification to the software to accommodate this as IB was threatening to lock down my account if I did not take any action.

The next issue that I encountered was the fact that IB does not store the “Order Reference” field of an order for hsitorical puposes. The Order Reference field is an order attribute which can be used to place any text String. I have been make use of this field to differentiate orders that were place by the 60-minute vs. 5-minute strategies. This field then shows up in Trader Workstation (TWS), in the execution reports. Unfortunately these are only stored for one week. And the historical queries available on the Account Management website for whatever reason do not provide this field, so long store short, I was not able to reconcile trades for the first day of the week (Sunday March 26th).

The other glaring issue is that TWS is throwing back “Duplicate Order ID” errors in some cases when the software places the limit entry orders. I’ve added some debugging statements, but everything looks like it should be working correctly, so this one may take a bit longer to figure out.

On to this past week’s results

AUD/NZD

This week I began trading a version of the AUD/NZD strategy based on 5-minute bars similar to the EUR/CHF strategy that I am currently testing. Results for the week weren’t great, but I’ll continue trading for a few weeks before pulling the plug if things don’t improve. Once again, the backtests are overly optimistic. The 60 minute version of the strategy had a rough week in both live and paper trading, but backtests showed a slight profit.

AUD/NZD – 5 minute – week of 3/26/12

| Backtest | Paper Trading | Live Trading | |

| # of Trades | 33 | 16 | 18 |

| Winning Trades | 90.9% | 93.8% | 83.3% |

| Avg. Trade (ticks) | -0.32 | -1.09 | -1.54 |

| Total Profit/Loss (Ticks) | -10.6 | -17.5 | -27.8 |

AUD/NZD – 60 minute – week of 3/26/12

| Backtest | Paper Trading | Live Trading | |

| # of Trades | 19 | 10 | 10 |

| Winning Trades | 84.2% | 70.0% | 70.0% |

| Avg. Trade (ticks) | 0.71 | -2.9 | -3.48 |

| Total Profit/Loss (Ticks) | 13.5 | -29.0 | -34.8 |

AUD/NZD –60 minute – Total (since 3/11/12)

| Backtest | Paper Trading | Live Trading | |

| # of Trades | 52 | 43 | 42 |

| Winning Trades | 84.6% | 79.1% | 80.9% |

| Avg. Trade (ticks) | 1.36 | -0.40 | -0.39 |

| Total Profit/Loss (Ticks) | 70.8 | -17.2 | -16.4 |

EUR/CHF

The EUR/CHF strategy had modest gains for the week, but still hasn’t made up for the first bad week that the strategy encountered.

EUR/CHF – 5 minute – week of 3/26/12

| Backtest | Paper Trading | Live Trading | |

| # of Trades | 72 | 21 | 28 |

| Winning Trades | 88.9% | 85.7% | 100% |

| Avg. Trade (ticks) | 0.22 | -0.33 | 0.325 |

| Total Profit/Loss (Ticks) | 13.6 | -6.9 | 9.1 |

EUR/CHF – 5 minute – Total (since 3/11/12)

| Backtest | Paper Trading | Live Trading | |

| # of Trades | 127 | 29 | 37 |

| Winning Trades | 92.1% | 89.6% | 100% |

| Avg. Trade (ticks) | 0.36 | -0.09 | 0.28 |

| Total Profit/Loss (Ticks) | 45.9 | -2.6 | 10.5 |

EUR/CHF – 60 minute – week of 3/26/12

| Backtest | Paper Trading | Live Trading | |

| # of Trades | 28 | 14 | 16 |

| Winning Trades | 89.3% | 78.5% | 75.0% |

| Avg. Trade (ticks) | 1.09 | 0.47 | 0.31 |

| Total Profit/Loss (Ticks) | 30.4 | 6.6 | 4 |

EUR/CHF – 60 minute – Total (since 3/11/12)

| Backtest | Paper Trading | Live Trading | |

| # of Trades | 59 | 42 | 49 |

| Winning Trades | 86.4% | 85.7% | 85.7% |

| Avg. Trade (ticks) | -0.50 | -0.81 | -0.58 |

| Total Profit/Loss (Ticks) | -29.5 | -34.1 | -28.6 |

Eurodollars

The Eurodollar version of the strategy had another poor showing this week, losing –8.0 ticks, and is down –20 ticks total in the last 3 weeks. Based on these results I will be discontinuing testing of this variant of the strategy.

Eurodollars Live trading

| Week of 3/26/12 | Total Since 3/11/12 | |

| # of Trades | 10 | 30 |

| Winning Trades | 50% | 56% |

| Avg. Trade (ticks) | -0.80 | -0.66 |

| Total Profit/Loss (Ticks) | -8.0 | -20 |

Twitter: @LimitUpTrading

Twitter: @RobTerp